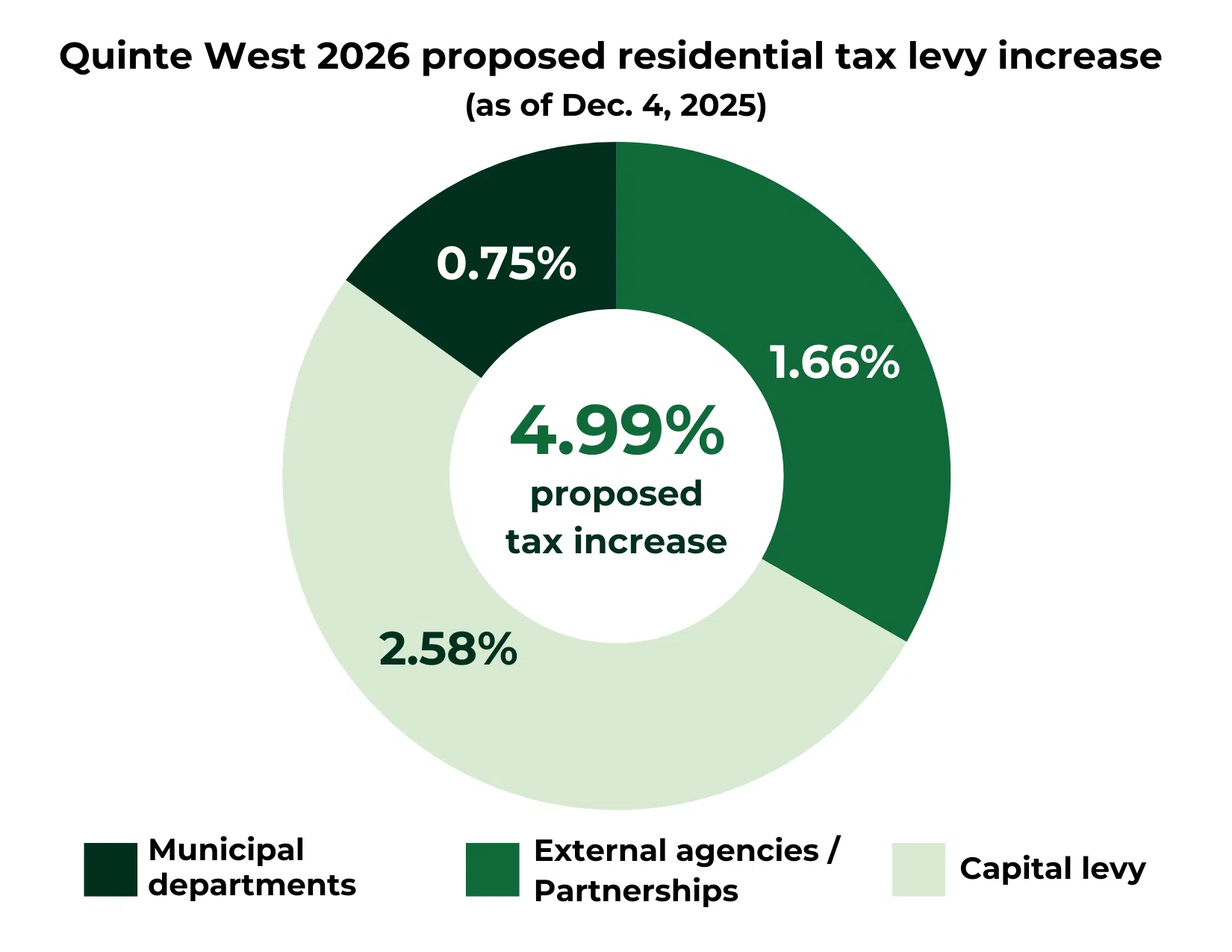

The City of Quinte West has announced it will be proposing a 4.99% tax levy increase for 2026 when it begins its budget deliberations.

In a release, the city says that this rate is lower than what would otherwise be required to maintain existing service levels and infrastructure due to revenue and cost-saving efforts.

These include:

- $835,000 in new revenue from a 1% growth in property tax assessments

- $731,000 in savings from the city’s transition to Ontario’s producer-led recycling system

- An increase in the funds received by the city from the Ontario Community Infrastructure Fund (OCIF) to pay for infrastructure projects, and

- More accurately recovering shared costs for capital projects and water and wastewater services.

The city says that the 2026 budget avoids new debt, addresses provincial funding gaps, rising service costs, and strengthens capital reserves to tackle the city’s infrastructure deficit.

Quinte West Council will review the proposed 2026 City Budget and Water and Wastewater Budget during a two-day sSpecial council meeting from December 10 to 11.

You can read the full release from the city below:

The City of Quinte West will begin deliberations on the proposed 2026 Budget outlined in the Ccity’s 2026 Budget Book. The 2026 Budget Book allows council and the public the greatest amount of time possible to review next year’s proposed budget.

The 2026 budget proposes an average residential tax increase of 4.99%. This rate is lower than what would otherwise be required to maintain existing service levels and infrastructure due to revenue and cost-saving efforts, including:

$835,000 in new revenue from a 1% growth in property tax assessments

$731,000 in savings from the city’s transition to Ontario’s producer-led recycling system

An increase in the funds received by the city from the Ontario Community Infrastructure Fund (OCIF) to pay for infrastructure projects, and

More accurately recovering shared costs for capital projects and water and wastewater services.

While the city continues to sustain new and existing financial pressures, the 2026 budget avoids new debt, addresses provincial funding gaps, rising service costs, and strengthens capital reserves to tackle the city’s infrastructure deficit.

Responding to provincial funding gaps

The proposed 2026 budget increases city funding to offset provincial shortfalls and downloaded responsibilities for maintaining resident access to healthcare services. The budget allocates $746,000 to this expense, nearly the equivalent of 1% of the total tax levy. Healthcare is a key provincial responsibility that the city is supporting to improve the community’s access to primary care.

Rising service costs

The proposed 2026 budget continues to experience rising costs for essential community services. The budget includes an anticipated 7.3% increase in funding to Hastings County. This additional $969,000 is a 1.1% tax levy increase alone, for services such as paramedics, long-term care, and social housing. The budget also addresses an anticipated 11% increase in Ontario Provincial Police (OPP) service costs to Quinte West. This increase represents an additional $1,040,000 to the budget, which is a 1.2% tax levy increase alone in 2026.

Addressing the existing infrastructure deficit

The city’s infrastructure deficit reflects a financial gap between the spending needed to maintain and upgrade city infrastructure (such as roads, bridges, and water systems), and the actual money available for these capital projects.

The proposed 2026 budget continues council’s plan to reduce this deficit with a 2.58% contribution to the capital levy, while prioritizing the maintenance of key city infrastructure.

Quinte West Council will review the proposed 2026 City Budget and Water and Wastewater Budget during a two-day special council meeting Dec. 10-11.

Council will review the city’s proposed 2026 internal departmental budgets at the meeting on Dec. 10, and receive delegations from a selection of external agencies on Dec. 11.

Quinte West residents are welcome to provide comments or address council as part of the budget review process. Public input can be submitted in writing to clerk@quintewest.ca for distribution as correspondence to council.

Individuals wishing to address council in-person or virtually at an upcoming council meeting can attend any of the budget review meetings to speak during the public input period. More information about the city’s Speaking at Council process is available at quintewest.ca/council.